It solely covers accidents not pure loss of life or damage from sickness. The bounds will rely in your specific coverage.

Unintentional Loss of life And Dismemberment Advert D Insurance coverage

Unintentional Loss of life And Dismemberment Advert D Insurance coverage

The Execs and Cons of ADD.

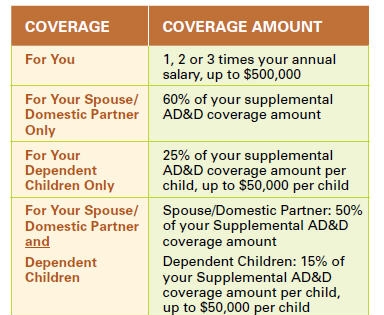

What’s supplemental advert&d insurance coverage. These insurance policies could not require a medical examination and are given group charges primarily based on age. An worker have to be enrolled in Complement Worker ADD insurnace protection to be eligible to enroll in Supplemental Dependent ADD insurance coverage protection. Supplemental Life Insurance coverage Metlife.

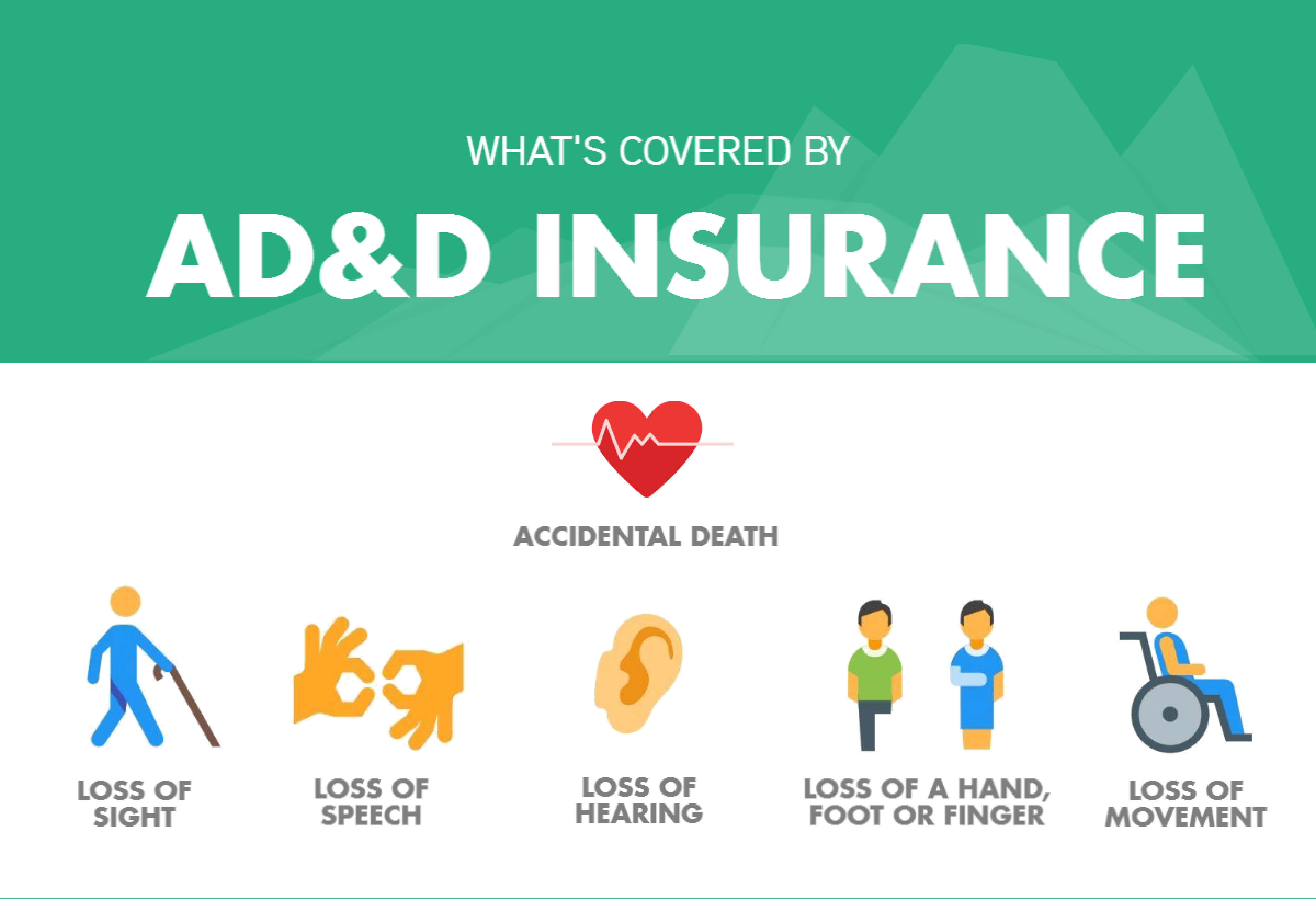

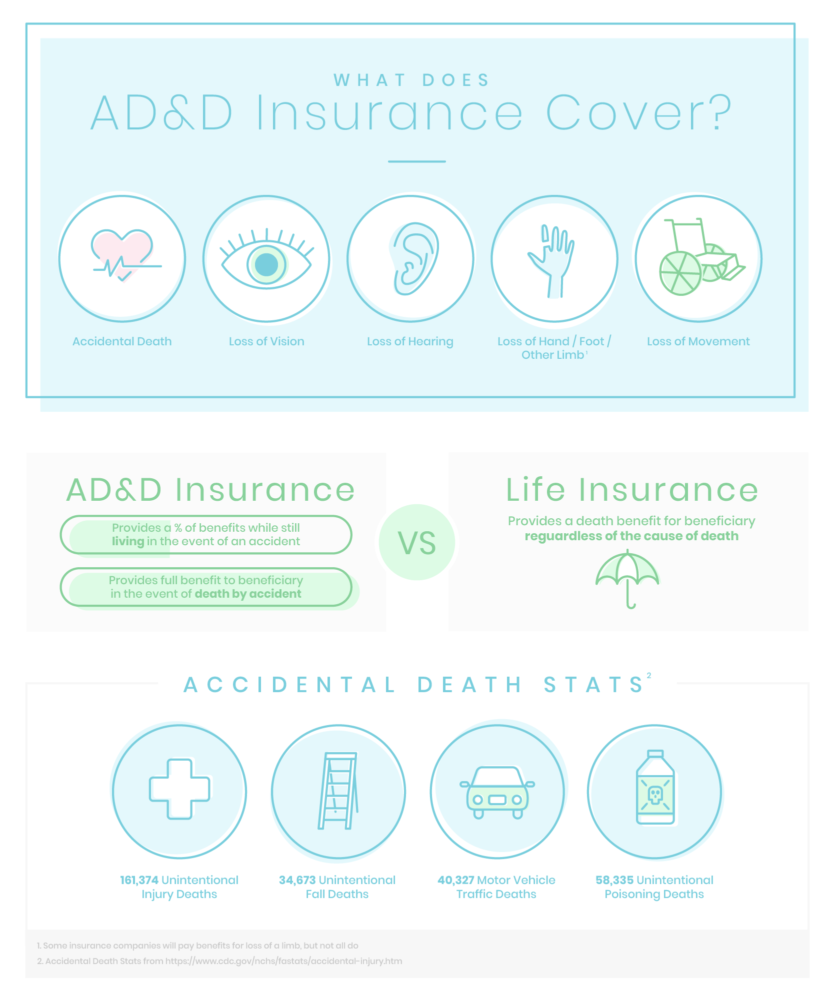

Supplemental life insurance coverage is usually provided by work however you may also purchase direct. AD D insurance coverage pays advantages if you happen to undergo a lined accident that ends in paralysis or the lack of a limb speech listening to or sight or if you happen to undergo a lined deadly accident. Nevertheless ADD protection isnt practically as sturdy as life insurance coverage.

Unintentional loss of life and dismemberment ADD insurance coverage provides your staff added monetary safety in sudden and tragic circumstances. ADD insurance coverage premiums are as little as 60 per 12 months relying on the quantity of protection you purchase and the advantages it supplies. Injuring oneself on objective.

Its a restricted unintentional loss of life and dismemberment ADD insurance coverage coverage. Unintentional loss of life and dismemberment ADD insurance coverage is an insurance coverage coverage that pays a loss of life profit upon the unintentional loss of life of an insured or upon the lack of a limb on account of an accident. Listed here are some frequent phrases to search for.

The voluntary consumption or use by. Employers usually require you to purchase a supplemental coverage for your self earlier than being eligible for supplemental partner or. Supplemental ADD Insurance coverage protection doesn’t embody cost for any loss which is brought on by or contributed to by.

Even when its not an accident you cant be out sick beforehand. You should purchase ADD insurance coverage as a separate product or endorsement in your life insurance coverage coverage. Bodily or psychological sickness analysis of or therapy of the sickness.

Supplemental insurance policies for the others in your life could also be simply as necessary. Supplemental life insurance coverage is much like a gaggle time period life insurance coverage coverage however is often extra restricted. Accidents can occur instantly however the penalties can final a lifetime.

Some employers present staff with the choice to buy supplemental life insurance coverage that will increase protection and doesn’t have stipulations similar to ADD or. ADD insurance coverage shouldn’t be a substitute for all times insurance coverage. ADD can complement life insurance coverage as a result of it would pay out if you happen to lose a limb or eyesight or different non-death accidents lined by the coverage.

Spousal protection elections can’t exceed 100 of the worker election quantity ie worker elects 100000 for self partner most is. We clarify who its finest for. I didnt know this.

Supplemental life insurance coverage vs ADD Some employers provide supplemental advantages which might embody life insurance coverage. Nevertheless these insurance policies usually have some exclusions. ADD insurance coverage is usually cheap and its frequent for employers to supply a small coverage to their staff as an alternative choice to life insurance coverage.

Most individuals find out about supplemental life and ADD Accident Loss of life and Dismemberment Insurance coverage however neglect about complement life insurance coverage for a partner or little one. Understanding its advantages and prices may help you resolve whether or not shopping for supplemental ADD. ADD insurance coverage could be a priceless and low-cost addition to your present advantages bundle.

Supplemental ADD is a sort of insurance coverage that pays out clearly outlined money advantages if an accident causes loss of life blindness or the lack of a number of limbs. The price of this profit is paid on an after-tax foundation. Supplemental ADD insurance coverage typically provided alone or as a complement to different life insurance coverage applications supplies further cash to your beneficiaries within the occasion you die or turn out to be dismembered in an accident.

Take into accout ADD shouldn’t be an alternative choice to. It may be an inexpensive option to complement your life insurance coverage or medical protection if youre critically injured or die because of an accident. ADD insurance coverage pays out if you happen to die or are critically injured in an accident.

In lots of situations the supplemental life insurance coverage that your employer gives you is in actuality an ADD insurance coverage coverage and shouldnt be confused with an ordinary life insurance coverage coverage. It provides individuals or protection to your coverage. Thanks for the knowledge.

An an infection except brought on by an exterior wound unintentionally sustained. Whereas an ADD coverage supplies advantages to your beneficiaries if you die the caveat. Suicide or tried suicide.

If you happen to can afford it ADD insurance coverage ought to complement your life insurance coverage coverage or you must add on an ADD rider. What it appears to me is that this supplemental insurance coverage acts very very similar to ADD insuranceyou must die whereas youre actively employed to get it. An unintentional loss of life and dismemberment ADD insurance coverage coverage may help defend your familys funds within the occasion of the lack of your life or limb s.

Voluntary Life Insurance coverage Quickquote

Voluntary Life Insurance coverage Quickquote

Pin On Let Me Defend Your Household Test Out Ail

Pin On Let Me Defend Your Household Test Out Ail

Life Insurance coverage Plans American Constancy

Life Insurance coverage Plans American Constancy

Car Legal responsibility Insurance coverage Purchase Well being Insurance coverage Life Insurance coverage Coverage Getting Automotive Insurance coverage

Car Legal responsibility Insurance coverage Purchase Well being Insurance coverage Life Insurance coverage Coverage Getting Automotive Insurance coverage

Car Legal responsibility Insurance coverage Purchase Well being Insurance coverage Life Insurance coverage Coverage Getting Automotive Insurance coverage

Car Legal responsibility Insurance coverage Purchase Well being Insurance coverage Life Insurance coverage Coverage Getting Automotive Insurance coverage

12 Methods To Save On Time period Life Insurance coverage Insurance coverage Com Time period Life Life Insurance coverage Coverage Insurance coverage Advertising

12 Methods To Save On Time period Life Insurance coverage Insurance coverage Com Time period Life Life Insurance coverage Coverage Insurance coverage Advertising

What To Know About Advert D Insurance coverage Forbes Advisor

What To Know About Advert D Insurance coverage Forbes Advisor

Supplemental Life And Advert D Protection Expanded For 2019 Hub

Supplemental Life And Advert D Protection Expanded For 2019 Hub

What Is Thought of Unintentional Loss of life For Insurance coverage Functions Glg America

What Is Thought of Unintentional Loss of life For Insurance coverage Functions Glg America

Advert And D Insurance coverage Definition Advantages Protection Payouts

Advert And D Insurance coverage Definition Advantages Protection Payouts

Car Legal responsibility Insurance coverage Purchase Well being Insurance coverage Life Insurance coverage Coverage Getting Automotive Insurance coverage

Car Legal responsibility Insurance coverage Purchase Well being Insurance coverage Life Insurance coverage Coverage Getting Automotive Insurance coverage

/GettyImages-1150533165-1ec0b791840d4c64bfd9f5b76c3c901a.jpg) Unintentional Loss of life And Dismemberment Advert D Insurance coverage Definition

Unintentional Loss of life And Dismemberment Advert D Insurance coverage Definition

Lifeinsurance Classifications Or Classes Will Range Barely By Insurer However In Many Circumstances There Is Some S Life Insurance coverage Insurance coverage Life Insurance coverage Corporations

Lifeinsurance Classifications Or Classes Will Range Barely By Insurer However In Many Circumstances There Is Some S Life Insurance coverage Insurance coverage Life Insurance coverage Corporations

12 Methods To Save On Time period Life Insurance coverage Insurance coverage Com Time period Life Life Insurance coverage Coverage Insurance coverage Advertising

12 Methods To Save On Time period Life Insurance coverage Insurance coverage Com Time period Life Life Insurance coverage Coverage Insurance coverage Advertising

Advert D Protection Infographic Texas Bar Personal Insurance coverage Trade

Advert D Protection Infographic Texas Bar Personal Insurance coverage Trade

Unintentional Loss of life Dismemberment Advert D Insurance coverage

Unintentional Loss of life Dismemberment Advert D Insurance coverage

What Is Advert D Insurance coverage Youtube

What Is Advert D Insurance coverage Youtube

What Is Unintentional Loss of life And Dismemberment Advert D Insurance coverage

What Is Unintentional Loss of life And Dismemberment Advert D Insurance coverage

The 5 Greatest Advert D Insurance coverage Suppliers Termlife2go

The 5 Greatest Advert D Insurance coverage Suppliers Termlife2go